A few weeks ago I began an experiment to find out what questions people were asking ChatGPT about their personal finances. The goal was to test its answers myself and report back to you the good, the bad, and the misleading.

I talked about the biggest question people asked in this post here. But we’re far from done.

Another popular question Canadians asked ChatGPT was: How do I budget better and save more?

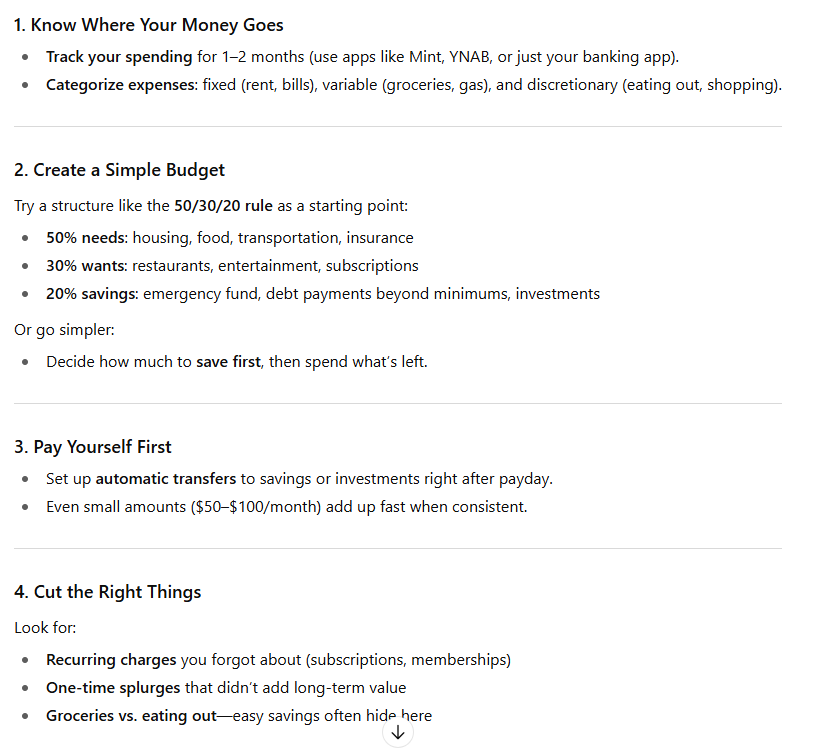

I asked this myself and here’s what ChatGPT told me:

This doesn’t seem too scary, right? It’s a fairly short to-do list with clear bullet points. The steps seem simple, even easy to implement.

But when is life ever that easy?

I see a lot of clients getting stuck in the first two steps, never even getting to steps three and four.

Why do these first two steps tangle so many of us up? Let’s break it down.

Step 1: Know Where Your Money Goes

(…and why that’s way harder than it sounds!)

ChatGPT suggests tracking your spending for 1–2 months, categorizing your expenses (fixed, variable, discretionary), and reviewing your habits. On paper, this is a great place to start, but in practice this is often where things fall apart.

Tracking your spending is mentally and emotionally loaded. It requires time, energy, and emotional resilience, especially if you already feel anxious or unsure about your finances.

I’ve worked with clients who have PTSD, ADHD, executive dysfunction, burnout, or just full plates, and for them, sitting down to review their transactions can be overwhelming to the point of avoidance. Even for highly driven people, the idea of manually inputting data into a spreadsheet and then drawing conclusions from it can be too much. That’s because you’re not just looking at numbers, you’re confronting choices, stressors, and sometimes shame. Reviewing a budget spreadsheet can feel like failure instead of empowerment.

Even for those who do try to track, the tools themselves can be a barrier. Mint, once a favorite, no longer exists in Canada, and finding a replacement isn’t always straightforward. And if you do manage to find a decent app, you’re still left with the task of interpreting the data and turning it into meaningful change.

This is why so many clients come to me feeling like they’ve already failed. But in most cases, the problem isn’t discipline, it’s the system.

In the office here, we use PocketGuard. It links to your accounts, organizes your spending into custom categories, and helps you see patterns without judgment. My assistant Shelby helps clients get fully set up so there’s no barrier to entry and no tech stress. We even give you monthly questions for meaningful reflection. And if you want to dig deeper, we can review your reports together during a planning session.

The goal here is always progress, not perfection. And progress starts by understanding where you’re at without shame.

Step 2: Create a Simple Budget

(…but how simple is it really?)

The next step ChatGPT recommends is creating a budget using the 50/30/20 rule:

- 50% of your income goes to needs

- 30% to wants

- 20% to savings

This framework gets thrown around a lot because it’s easy to remember and offers a clear structure. But very few Canadians can actually follow it, and for good reason.

Breaking the numbers down, it becomes clear why:

- According to RBC’s Housing Trends report, mortgage payments plus taxes and utilities now consume 60% of the median household’s income.

- Renters aren’t off the hook: With rents rising 9% year over year in most major cities, many are spending 30–44% of income on rent alone, not including bills or transportation. (Rentals.ca, 2024).

- Food prices are up nearly 20% since 2021, and still climbing. (Canada Food Price Report)

- Inflation and rising interest rates have squeezed every category of the budget.

And this doesn’t even account for debt, which is a major obstacle for many Canadians. The average household owes $1.85 for every $1 of disposable income (StatsCan, 2025). And 1 in 3 people say that debt payments are the main reason they can’t save regularly (MNP, 2024).

So yes, creating a budget matters but not if the model you’re trying to follow was never realistic to begin with.

Which brings me to a very important point: Life isn’t just about saving money. We all want to live too. Many of my clients come in worried that even if they did build a budget like this, they’d be left with nothing for a social life, travel, or joy. They’re afraid that budgeting means giving up their quality of life, and if that’s the trade-off, they’d rather look the other way and live with the stress.

That means a lot of ignoring the gnawing feeling of dread when you avoid looking at your bank account while trying to live a full life. It’s an anxiety that feels familiar to a lot of people right now.

So it’s no wonder that:

- 53% of Canadians are living paycheque to paycheque, with little room for emergencies (National Payroll Institute, 2023)

- Even among households earning $100K+, 36% still report living paycheque to paycheque

- Only 28% of young adults (18–34) feel confident managing money (CPA Canada, 2023)

So when ChatGPT suggests automating savings as the next step, it’s easy to see why so many people never get that far.

Without a strong foundation of awareness (and tools that work for you), the rest of the list starts to feel out of reach. Financial stress and overwhelm is very real and it can feel too big to tackle, so is the first step really just knowing where your money goes? Or is it something else?

What’s the Real First Step?

Short answer: It’s the understanding that it’s possible to budget and still live a full life without money-anxiety around every corner.

Long answer: If budgeting were as simple as asking AI to generate a to-do list, you probably wouldn’t have needed that list in the first place because you’d already be doing it.

The truth is, the way we talk about budgeting is misleading and way too loaded with moral judgments. We act like it’s just a matter of discipline when the reality is it’s actually a matter of capacity and support. Budgeting doesn’t need to be perfect, it just needs to be possible.

Sometimes the real value of financial planning isn’t in giving you more information, it’s in creating a structure that works for your life. I’ve yet to sit down with a client and not find a path forward that balances progress with breathing room.

You don’t need to do this alone. You don’t need to hand over every bank statement. And you don’t need to feel ashamed. Nobody is born with this knowledge, and you’re not doing something wrong if you feel adrift.

If you’re stuck and want to take a first step (one that’s actually doable in your life) I’d love to work with you through our Starter Plan, designed for exactly this. We’ll build a system together that works for you, at your pace. No judgments. No shame. It’s all about supporting you in your specific circumstances and building structure that you can stick to.

After all, a plan that works for real life is the only plan that’ll stick, and that’s exactly what I’m here to help you with.

I’ll be back soon with another question I’ve put to ChatGPT, but in the meantime, don’t forget to fill out my anonymous survey on the ways you use AI tools for your personal finances. The answers will help shape my future posts about this to make sure it’s as useful as possible for you.

👉 https://sperofinancialgroup.fillout.com/t/mRTtFSCyaFus👈